Biden makes plans for student loan forgiveness, but will plans help or hurt America?

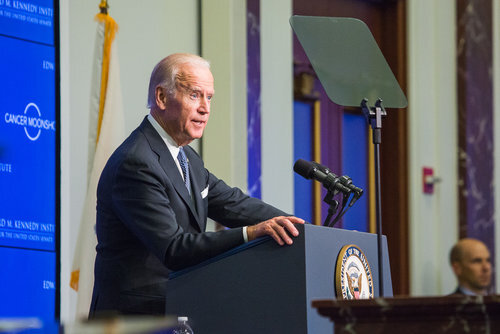

President Biden announced his student loan forgiveness plans last week in front of news reporters.

August 29, 2022

On Aug. 24, President Biden announced his plan to cancel up to $20,000 of student loans for those who qualify. Along with this, he would extend the pause on monthly payments, including interest, until at least January 2023. While many have different opinions, it is important to know how this will affect Americans today.

Who qualifies for the plan?

Biden claimed that if this bill gets passed through the House of Representatives he would cancel $10,000 of student loans if the individual has a salary less than $125,000 (2020 or 2021 income figures). However if someone files for taxes jointly or is head of the household and makes less than $250,000 (2020 or 2021 income figures) then they could also qualify. Along with this, those with the Pell Grant would also receive an additional $10,000.

“In the short term it helps out kind of the wrong people is what every economist is saying and in reality it does. If you look at the people that it’s helping based on the numbers, the top 60% of earners, it doesn’t help out those who are lower income because they’re not the ones who went to college and have student debt,” said John Aspel, a business teacher at Lemont High School.

Since the plan was finally announced it will still take a while before finding out the process to apply for this forgiveness, but so far a site is in the works.

Why is student loan forgiveness going to affect taxpayers?

Since the announcement, many have already started taking sides on whether or not this action should even be done. In the United States there is a total of $1.748 trillion in student loan debt (July, 2022) and canceling a small portion will cause inflation and taxes to rise all over the country.

Aspel said, “It has been projected to cost between $300 billion and $500 billion…I think that is going to have a negative impact.”

Many fear that with inflation at an all time high, this will cause more problems than it will solve. People opposed to the proposed plan debate that since President Biden also gave a pause for student loans, nothing further should be done, despite the affects the pandemic has had on many college students.

“I think the biggest argument of all is what problem does it solve, and in reality it doesn’t solve the biggest problem of all which is the cost of higher education and really that is the problem we need to be attacking in the first place. This is simply a bandaid on a gushing water pipe,” said Aspel.

Are there other ways to aid student loan forgiveness?

While some believe that this plan is positive, others have tried to discuss the reality of the problems that need to be addressed within student loans. The average cost of college education in the United States is $35,551 per year (Aug. 2022), which doesn’t include the interest that is accumulated throughout an individual’s life.

Aspel noted, “Before anybody signs those documents, educate yourself, talk to your parents, start early in saving for your own education, a lot of scholarships available and there is nothing wrong with working while you’re going to school at the same time.”